Question:

As a freelance graphic designer, how should I define myself regarding business structure for legal reasons, i.e. Sole Proprietorship, LLC, or S Corporation?

-Lisa

Answer:

Lisa,

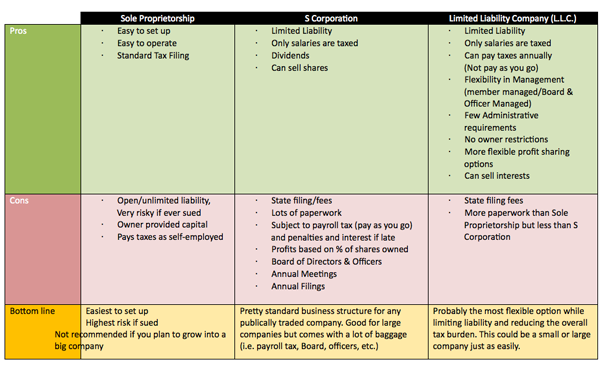

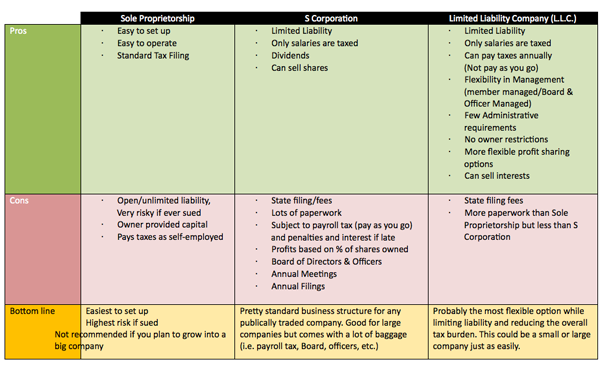

I know conventional wisdom says to never answer a question with a question but I think I am going to have to in this case. All of these business structures have their strengths and weaknesses, the real question is which is the best fit for you. You have to figure out how big do you want to get, how much paper work do you want to do, and how worried are you about being sued and government taxation. The answers to those questions will lead you to the choice that is right for you.

For ease of comparison it is better to use a table. See the table below:

One of the most confusing differences (from what I understand) between an S Corp and an L.L.C. is the payroll tax. S-Corporations are subject to payroll tax, which is a pay-as-you-go tax, meaning you have to pay it as you get paid or be subject to penalties and interest. Where as a L.L.C. can pay taxes like s sole proprietorship, meaning once annually, unless you wanted to break it up throughout the year (which would be optional).

Ultimately the decision is yours. I am not a CPA or a lawyer and whatever you are considering doing from a business structure standpoint, I would consult one or both of these professionals to make sure that you fully understand the requirements, legal, financial and otherwise before taking the plunge.

Hope that is helpful and good luck in building your business.

-Ken